Supreme Chaos

Why the Supreme Court's decision to review a key TCJA provision could upend the international tax system at a fundamental level.

Two weeks ago, I wrote:

Sometimes I’ll hear people talk about foreign income like it’s literal cash or gold that’s been stocked away, out of reach from the Internal Revenue Service unless we decide to send in the Marines. But actually, it’s our very laws which define that income as existing offshore at all.

What I was getting at is that there’s no legal reason why we have to recognize overseas income as being overseas at all, or why we couldn’t tax it immediately as if it was earned right here.

But…maybe this is wrong?

A Supreme Court announcement on Monday may call this idea into question. The Court is going to take up Moore v. United States, what had previously been seen as a longshot constitutional challenge to the 2017 Tax Cuts and Jobs Act’s repatriation tax. So far, the plaintiffs haven’t won in any courtroom, but they’ve worked their way up the appeals circuit and the nation’s top court decided they deserve a hearing.

This shocked many legal and tax analysts, not only because of the long odds. If successful, this case could have dramatic effects not only on the TCJA, but the entire U.S. tax code. The Moores’ complaint primarily concerns whether the repatriation tax is permitted as an income tax under the 16th Amendment. It isn’t, they argue, because the earnings in question were never “realized” in the U.S.--therefore, whatever it is, it’s not real income.

For reasons that are arcane and ultimately have to do with the taxation of slave plantations in early America, the U.S. Constitution mandates that “direct” taxes must be apportioned by state population–in other words, the tax can’t raise a greater percentage of income from a given state than that state’s portion of the overall U.S. population. This is regardless of that population's wealth or income. (This made it harder to tax plantations in the South, since Black Americans only counted at a 3/5ths rate for the Census at the time.) Given how impractical (and unfair) a state-apportioned tax would be, this has amounted to a constitutional ban on direct taxes. The only exception is for an income tax, allowed by the passage of the 16th Amendment in 1913.

Just as it was never entirely clear what a “direct tax” was, the 16th Amendment also allows for a broad definition of “income tax,” that we’ve been exploring the parameters for ever since. But the courts have generally interpreted it leniently. Is that about to change? Many think this particular Supreme Court, which hasn't been shy about knocking down decades of prior precedent, can't be counted out.

Much of the commentary since the Supreme Court’s announcement has focused on how this decision could bar future passage of a wealth tax, or a tax on unrealized capital gains. As debates about wealth inequality continue, this could lead to fewer options in the effort to even the imbalance between the taxation of assets and the taxation of income. (A dismissal, though, wouldn’t mean that a straight wealth tax is in the clear.)

But the effects on international taxation could also be profound, and devastating to the current global tax system. Almost by definition, international taxation concerns the taxation of income that hasn’t been generated here–a prohibition on that would require lawmakers to reconsider these issues at a very fundamental level.

The TCJA’s repatriation tax dealt with the piles of offshore income that had grown over the decades, earned by U.S. parent companies that had chosen not to bring the dollars home. They had the power to do this when the foreign subsidiaries were separate legal entities from the home company–a principle that goes back nearly to the founding of the income tax system. The law recognizes the subdivisions that a corporation imposes on itself, so long as those entities transact between themselves at reasonable market rates--the arm's-length standard . The law also recognizes the right of those entities to time a dividend payment--which is what a repatriation would be--whenever it wants.

The combination of these rights created a situation that no one would have ever wanted–an expectation of a tax payment but not a requirement, and a disincentive to reinvestment back home. The TCJA enacted a one-time tax–at 15.5% for cash and cash-equivalent assets, 8% for real investments–to transition to a new system that exempts most offshore income from taxation. (It’s called a repatriation tax but that’s technically a misnomer. The tax applies whether or not companies ultimately repatriate the income, and they’re not required to do so. But after the transition tax payment, they can repatriate without a further tax charge. I’ll still call it the repatriation tax, just for simplicity’s sake.)

The tax was admittedly a crude, blunt instrument, and it created plenty of legal controversies. Many of those involved the cash/investment split. It turns out there are a lot of grey areas when it comes to cash-equivalent assets, including Peruvian chickens. Undoubtedly, many taxpayers ended up with bills that weren’t exactly fair, or what they expected. But there was relatively little doubt about the overall tax’s legitimacy–after all, this was a U.S. tax on U.S. taxpayers earnings.

Nevertheless, Charles and Kathleen Moore decided to take the tax to court. As minority investors in KisanKraft, an Indian farm equipment manufacturer, they ended up owing $15,000 on the firm’s earnings that had been reinvested in the country. They argued that as mere investors, they’d never seen this income they were now responsible for paying taxes on–and that it’s clearly not an income tax.

As they were rejected by appeals courts, several conservative-leaning think tanks and industry groups began to support their case, arguing that a precedent against the Moores could open the doorways for Congress to enact a host of novel, theoretical levies under the guise of income taxation.

If the Supreme Court somehow narrowly shoots down the TCJA repatriation tax, but leaves the rest of the code untouched, that would have little effect other than to give many corporations a windfall of hundreds of billions of dollars.

But given the implications, that may not even be possible. More likely, a ruling in the Moores' favor would call into question large swaths of the international tax code.

For instance, the tax on global intangible low-taxed income, another key part of the TCJA, also immediately taxes the offshore earnings of foreign subsidiaries. It happens in real-time, as those earnings occur, unlike the tax on historic earnings in the Moores’ case. But it’s still essentially imputed to the home company. That likely could be considered unrealized income as well. GILTI is one of the key backstops to the TCJA, meant to ensure that the broad exemption of offshore income doesn’t lead to mass exodus of corporate cash.

For that matter, Subpart F–the basis for GILTI as well as the repatriation tax–also targets offshore income. This tax regime, enacted during the Kennedy Administration in 1962, targets passive forms of income like interest, rents and royalties earned offshore. You could argue that this is realized income, but so long as the separate entity principle is respected then it’s not realized to the corporation that’s paying the tax.

Our system has long depended on having an essential backstop to simple forms of profit-shifting. Without it, we only have the arm’s-length standard, with its subjective determinations of value, standing in the way of the total erosion of the U.S. corporate tax base–and history has shown us that it’s not a good gatekeeper on its own. Ironically, in its goal for creating territorial taxation, the TCJA was required to expand U.S. taxation of imputed offshore earnings.

In theory, a ruling in favor of the plaintiffs would be favorable to corporate taxpayers. But it’s a gamble they may want to think twice about taking. It’s hard to know what would come of such an unpredictable situation–perhaps Congress would respond by enacting total immediate worldwide taxation. (I’m not even sure that would work, but they could try.)

To get right down to it, is the arm's-length principle even compatible with a new legal regime that only recognizes realized income? If not, what would take its place?

I’ve written many times that the difficulty in corporate taxation lies fundamentally in the inherent elusiveness for a definition of “income"--it turns out this isn’t just true in terms of measurement, but in legality as well. While ultimately little may come of this particular case, it could shine a light on the next ideological battlefield for taxation. If we redefine all offshore income as unrealized, theoretical and untaxable, it requires some fundamental rethinking of how we deal with corporations entirely.

DISCLAIMER: These views are the author's own, and do not reflect those of his current employer or any of its clients. Alex Parker is not an attorney or accountant, and none of this should be construed as tax advice.

LITTLE CAESARS: NEWS BITES FROM THE PAST WEEK

- The Supreme Court announcement was the big international tax news of this week. But there was also the Congressional Budget Office’s annual long-term budget outlook, eagerly anticipated by budget wonks everywhere. Speaking of the repatriation tax, CBO estimates that corporate tax receipts will fall for the next few years, in part because repatriation payments will start to decline. (Companies had the option to spread them out over 8 years.) But corporate tax revenue will shoot back up when more of the TCJA’s provisions expire or future rate increases go into effect–if Congress lets that happen.

- A constant tension in the Organization for Economic Cooperation and Development’s project on taxation in the digital economy is that inadequate taxation of online transactions is kind of a First World problem. (Albeit, a very important First World problem.) That’s why Amount B is a crucial link if the full project is ever going to come together. The South Centre, a think tank established by 55 developing countries, published an interesting policy brief looking at this issue, and connecting it to efforts to better connect Africa to the Web. Worth a look.

- The OECD also issued a report on progress in tax transparency in Latin America. The conclusion: the region has made strong gains in enforcement against tax evasion, capturing more than $30 billion through information exchange networks. But those gains haven’t been evenly distributed–many jurisdictions are still catching up in learning how to make use of these new tools.

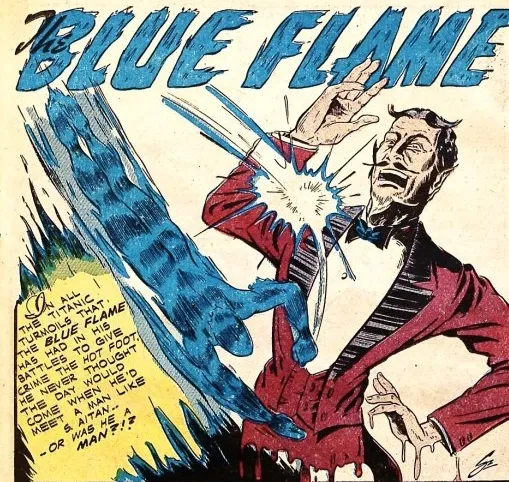

PUBLIC DOMAIN SUPERHERO OF THE WEEK

Every week, a new character from the Golden Age of Superheroes who's fallen out of use.

The Blue Flame, whose first and only appearance was in Captain Flight #11, 1947. While in his costume of blue trunks and...not much else, he can burst into a blue flame, capable of flying at high speeds. Presumably, a lot more would have been explained in future appearances.

Contact the author at amparkerdc@gmail.com.